What happens when you bring startup culture - hackers, hipsters & hustlers - into a large enterprise?

Globe Telecom (Philippines' #2 telco with 42% share) incorporated Kickstart Ventures Inc. to break down barriers to disruptive innovation that couldn't survive inside an established telco. The mandate: spur innovation by supporting startups with funding, access to telco facilities, mentoring programs and market access (ie business network introductions).

Most enterprises, esp telcos, approach corporate incubation as they do all things: as large, corporate entities with entrenched processes, formal channels and big budgets. Globe's Kickstart Ventures turns the corporate incubation model on its head by going grassroots and operating as a startup itself: independent, experimental, disruptive, personal. Kickstart's different processes, metrics, tools and small, unorthodox team (no one from the core telco business) goes beyond breaking down barriers between the corporation and startups: Kickstart builds bridges that enable effective collaboration between these disparate organisations.

Kickstart's grassroots approach is helping build a robust startup ecosystem in the Philippines. And it's disrupting Globe from the inside: and people in Globe are beginning to understand that that can be a very good thing.

Large enterprises are good at driving innovation through factory-like processes: innovation projects are approved based on scale, certainty and profitability; and configured for efficiency. Projects go through standard processes with standard milestones in a one-directional funnel, and success is measured with the same metrics used for the core business. This innovation model works well with "known knowns" and "known unknowns," when growth is infrastructure-driven, innovation can be controlled and evolutionary, and there are established playbooks to refer to.

It is much less successful for the frontier areas of industry, where there are higher, often unquantifiable degrees of uncertainty and risk; where disruption is bound to appear from the fringes rather than from traditional competitors; and where the innovation development process requires experimentation and rapid iteration. These innovation frontiers could look interesting to large enterprises, but interest quickly dissipates when a business case can't be made to justify exploring an innovative idea.

It doesn't look too good from the fringes either: often, corporates are seen as dinosaurs unable to adapt to a changing environment or work with startups that are small, iconoclastic, and fleet of foot. Whilst startups can benefit from the resources of a large corporation -- especially in an age where innovation cycles are shorter and the race to scale brings constraints in not just capital but also, crucially, market access -- they are well aware that enterprise processes can be slow and cumbersome, ultimately draining away a startup's time and energy, and killing creativity with control and compromises.

These barriers between large enterprises and agile startups represent a huge opportunity cost: much more economic value could be created by and for both types of organisations, if only they could learn to work with each other without tripping each other up. Equally important, the barriers prevent the rise of robust innovation ecosystems within markets, making innovation a "one-off" fortuitous event rather than an intrinsic and repeatable process that constantly stimulates customer behaviour.

Kickstart's Corporate Incubation formula: acknowledge the Innovator's Dilemma (Clayton Christensen) and work with it!

-

STRATEGIC STRUCTURE: Create a two-pronged approach for driving innovation within large enterprises, accepting that innovation from the core and innovation from the fringes are equally important for the long-term health of the enterprise, but are fundamentally different in nature - requiring different skills, processes, governance, metrics. Both structures report to the CEO, ensuring coordination where needed whilst avoiding swamping/throttling inovation from the fringes with the mass of the core business.

- Innovation from the Core - can be managed via an internal team for best core expertise, using innovation funnels and metrics that ensure that resources are allocated to projects that offer the highest expected value (probability of success x lifetime value created by success, weighed by time to launch) - this is not covered in this discussion, as innovation funnels and gating systems are well-established; but is mentioned to provide context

- Innovation from the Fringes - Corporate Incubation requires a dedicated team with different skill sets; develop different processes and metrics to measure success, accepting a different risk/time profile for incubated projects. This is the focus of this hack.

-

CORPORATE INCUBATION MANDATE

- Independent organisation: separate incorporation allows differing governance requirements for the investments that need to be made, often with less time and less information available, especially for never-before and first-in-market initiatives. Build a diverse team based on skill sets that thrive in this environment; avoid merely transferring "the usual suspects" ie executives who have been successful in the core business, but have no experience with startups. In Kickstart's case, we have someone who has been CEO in both a multinational company and startup environment; a former VC; a former SAP/CAS tech person; a CSR expert.

- Small, but separate fund: avoid the deprioritisation and mid-year corporate budget slash issues by operating on a small budget, and keeping this separate from core business. Keep approval processes appropriate by using investment threshholds.

- Portfolio approach: make a number of investments across the focus areas (in Kickstart's case, infra-light digital technology products/services, and technology-empowered traditional sectors). Balance these investments across categories and customers (B2B, B2C), and an investment size range.

-

Incubation metrics: acknowledge higher levels of risk, and longer incubation periods. Year One metrics are focused on Sourcing Innovation (how many startups we find), Innovation Relevance (how many startups we introduce to Globe and affiliate companies, who are deemed relevant by Globe/affiliate companies), Investment implementation (fund deployment), Investee satisfaction (survey feedback) and speed. These metrics will evolve over time, incorporating more strategic milestones and financial metrics as the investment portfolio and processes mature.

-

PRINCIPLES AND PHILOSOPHIES

-

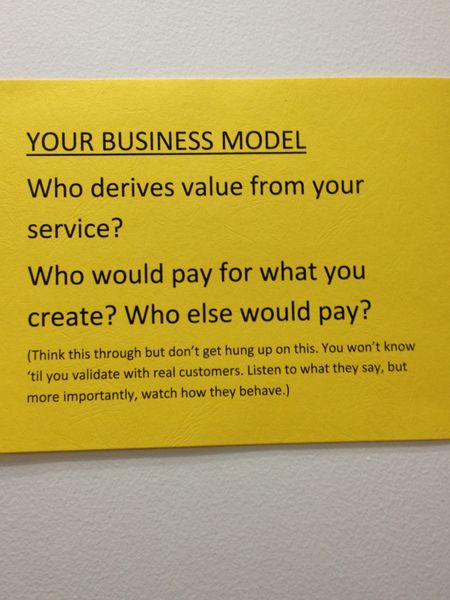

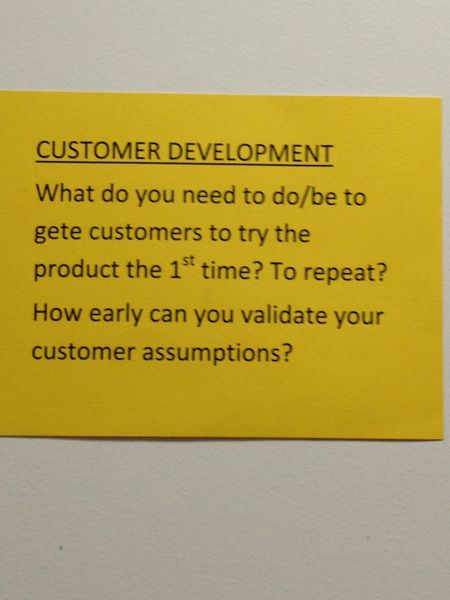

Operating philosophies: Given the infra-light focus, we espouse Lean Startup principles (Eric Ries) and use the Lean Canvas (Ash Maurya). We coach investees to articulate their problem and purpose clearly; and understand that customer and product development take experimentation, rapid iteration, rigorous discipline around results measurement, and potentially a lot of failures! We discuss each investee startup's results based on the Lean Dashboard (Pollenizer); and we encourage them to participate in the Startup Genome Project.

- Community philosophies: We are building the larger startup community, and therefore co-organise community events (eg Startup Weekend; Kickstart Startup Mixers) to stimulate interaction and collaboration. We bring in partners - large and small, domestic and overseas - to build up expertise. We encourage collaboration and intelligent risk-taking.

- Kickstart character: authenticity (integrity, simplicity, personal involvement), authoritativeness (competence, expertise, use of data as well as judgment), accessibility (grassroots/community/ startup-centric approach, responsiveness and speed, openness to genuine partnerships).

-

Operating philosophies: Given the infra-light focus, we espouse Lean Startup principles (Eric Ries) and use the Lean Canvas (Ash Maurya). We coach investees to articulate their problem and purpose clearly; and understand that customer and product development take experimentation, rapid iteration, rigorous discipline around results measurement, and potentially a lot of failures! We discuss each investee startup's results based on the Lean Dashboard (Pollenizer); and we encourage them to participate in the Startup Genome Project.

-

THE KICKSTART OFFER

-

Capital - seed funding for startups, in exchange for equity (minority stake) or via a convertible note.

- Resources - preferential access to telco platforms; credits for mobile advertising and mobile money integration; tools for targetted mobile customer surveys and validation

-

Mentoring - weekly discussions at early stage/monthly discussions at later stage. Structured discussions focused on hypotheses, experiments run and results obtained. We also bring in expert speakers for the community at large, and fund training workshops for our investee companies.

- Market access - we open doors for startups by organising introductions to affiliate companies as well as other business contacts. When needed, we monitor the interaction to help "translate" between startup and enterprise language. To help ease this interaction, we also host workshops and briefing sessions for executives of affiliate companies and business contacts -- to help them better understand and work effectively with startups (this is especially helpful given most executives are only experienced with dealing with companies of a similar size or maturity).

-

Capital - seed funding for startups, in exchange for equity (minority stake) or via a convertible note.

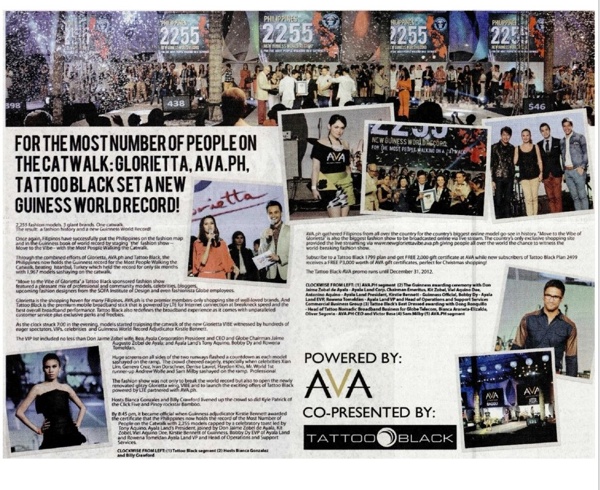

The COMMUNITY initiatives (Startup Weekend, Kickstart Startup Mixers) stimulate conversations amongst different community members -- Startup Weekend organisers and teams that pitch; large corporates who are potential sponsors or customers or suppliers; investors; government and non-government organisations. For example, we have had representatives from Google, Amazon, the US Embassy, and Innosight participating and taking questions from startup founders. We are building creative, collaborative communities of trust based upon personal experiences.

The COMMUNICATIONS initiatives -- Kickstart presence in hackathons and pitching competitions, publicity and PR, media efforts -- help create a better broad public understanding of startups, technopreneurship and disruptive innovation. In an Asian context, where social and familial expectations often pressure individuals to seek employment in stable corporations and conglomerates, these media efforts are necessary to re-shape attitudes and perceptions to make technopreneurship an acceptable, equally valid career choice.

StartUp Weekend Manila from Moki Magpantay on Vimeo.

The EDUCATION initiatives -- targeted at startup founders as well as corporate executives -- build a foundation for more effective cooperation: collaboration build on comprehension of each other's contributions, and more robust executional competence. We are developing more skills, more mature thought, and more disciplined execution -- this mitigates market adoption risk common to innovation projects.

The INVESTMENT initiatives give startups a faster start and a better trajectory. The investment of time and personal networks, in addition to funding, better aligns the interests of the startup founders and Kickstart. We are creating what we believe will be the case studies that help more people understand what drives innovation in emerging markets such as the Philippines (we cannot replicate Silicon Valley, but must build our own innovation community appropriate to the characteristics and capabilities of the Philippines). More importantly, we believe that we are building success stories that will inspire future generations -- founders and corporates alike -- to collaborate for mutual gain.

THE BOTTOM LINE: 24 months in, and we see early concrete results: real impact that harnesses talent in an emerging market (and not a traditional innovation hub) --

- 21 well-attended community events -- Startup Weekend, Kickstart Startup Mixers, #raidthefridge -- that offer networking opportunities and initiate deeper conversations, sparked by speakers like Braden Kelley, Scott Anthony, Amazon CTO Dr. Werner Vogels, Scan.me founder Garrett Gee, National Competitiveness Council's Bill Luz, Pollenizer's Phil Morle, the US State Department's Robin Diallo, and local startup founders like Kalibrr's Dexter Ligot-Gordon.

- 17 startups funded; supporting 47 founders

- 177 new jobs created within startup teams;

- 230 commercial deals signed by our portfolio companies;

- 521,262 users of the services and products launched by portfolio companies; with 33,985 paying customers;

- USD7.9 Million in third-party funding attracted after our initial investments (Kickstart is typically the first institutional investor for our startups).

We look to yielding a financial return on the investments in 5 years or so. Ultimately, the measurable economic value -- whether in shareholder dividends, firm value, succeeding funding rounds or a liquidity event; or macroeconomic measures such as companies started, revenue generated and employment created -- will demonstrate that Kickstart's corporate incubation is driving innovation, that in turn creates value for the Philippines as a whole, as well as for Globe and Kickstart Ventures.

Kickstart itself is the result of a series of experiments!

-

Co-organise Startup Weekend in your community. This isn't just about "sponsoring" it, ie handing a cheque; this actually requires rolling up sleeves and immersing in all the activities, talking to as many startup founders and aspiring founders or team members, as possible.

- Build a view of your market (external) conditions: what are the key drivers for innovation; which elements of an innovation culture/ecosystem are present, and which are not. What are prevailing attitudes of the different members of the ecosystem; who are the community leaders; where are the leverage points? Understand what the true limiting factors are (most people say "capital" but often that is just the tip of the iceberg).

- Take stock of your company's (internal) resources and attitudes: what capabilities are present; what do you need to acquire or develop or partner for?

- Build a hypothesis, and pitch the idea internally. In Kickstart's case, we pitched for -- and got approval for -- a small investment fund (US$2.4Mn), a small team (4-5 person), and an unusual degree of latitude (a separate company, a higher degree of risk-taking, and a different investment approval process). These were in view of an unusual degree of honesty in the pitch: we spelt out the risks involved, and offered no guarantees or misleading facts. And we promised to share information.

For the first year, we set out modest targets, focused on building capability and external relationships, and worked with internal sponsors who "got it" in parallel to doing more educational/evangelical work around disruptive innovation and startups, to broaden support. We are measuring and sharing findings -- these early results, indicating the promise of innovation as well as more specific drivers/needs, are generating greater support for what was originally seen as a radical and disruptive (in a bad sense) proposal.

The hackers, hipsters and hustlers are in the house -- and it's beginning to look like a good thing. In everyone's eyes.

- The Kickstart founding team -- Dan Siazon, Christian Besler, Ruth Canillas -- who joined me when I said we'd pitch to do Incubation and Open Innovation.

- Globe's CEO, Ernest Cu, and CFO, Albert de Larrazabal -- who understood intuitively why this is a good thing for Globe Telecom, who created the space to make this possible, and who continue to support Kickstart's initiatives.

- Globe's Board of Directors -- who accepted the candour and honesty of our pitch with an amazing degree of equanimity, openness and support.

- Our early team members -- Steve Macion, former Globe NBG Strategy guy and frequent sounding board for wild ideas; Pia Angeli Bernal, former NBG Education Strategy team member and early convert who moved over from Globe's CSR team to join Kickstart

- SingTel Innov8 - especially Yvonne Kwek and Edgar Hardless -- who shared all they could in the early days, and then helped create the early experiments that validated the model

- Our partners from the Philippine startup community -- especially the Startup Weekend Manila organising group; Jay Fajardo and Proudcloud

- Our early corporate partners -- notably Amazon Web Services, ZenDesk, Startup Weekend

Hackers in the house: how an UnCorporate Incubator drives disruptive innovation from the inside.

- Log in to post comments

You need to register in order to submit a comment.